From tech companies increasingly dominating vehicle manufacture to the spread of Tesla charging technology, PMM brings you the highlights from a recent report on the future of EVs by IDTechEx. The report, titled “IDTechEx Reveal the Future of EVs: Evolution of the Automotive Industry and Electrification Beyond Cars” is written by Dr James Edmondson, principal technology analyst and Shazan Siddiqi, senior technology analyst, IDTechEx and provides a global overview of the future of vehicle electrification.

2023 has proven another momentous year for the electric vehicle (EV) market. 2022 saw electric car sales rise by 62 per cent compared with 2021, and IDTechEx estimates that 2023 will see global sales rise by another 16 per cent. Growth in 2023 was somewhat hampered by the poor performance of plug-in hybrids (PHEVs) in Europe in the first half of 2023, with subsidy phase-outs in Germany. However, even with less aggressive growth than previous years, many will agree that EVs are the future, especially for the passenger car market. So what else can be learned about the future of electrification?

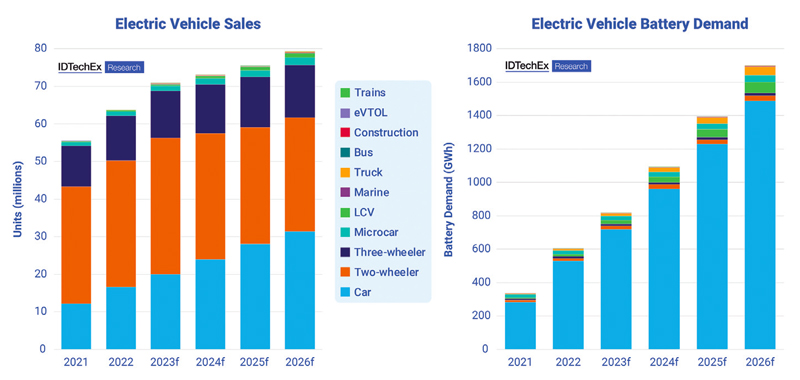

IDTechEx is predicting a fairly moderate 2-fold increase in the yearly sales of EVs across all the segments mentioned above by 2034; this is partly due to the sales of electric two- and three-wheelers already stagnating in some major markets. However, the battery demand increases by over 7.7 times in the same period, largely driven by the car market, but with the other segments making a significant contribution.

Technology companies becoming automotive suppliers

Tesla are undoubtedly leaders in the EV space, and it has changed the way that many think about the car as a product. The sales process is more akin to purchasing any other consumer electronics product than what is typically thought of when buying a car. In addition to this, the ownership is taking that form too; many EVs now offer over-the-air updates to keep a car’s systems up to date, whereas, for example, many traditional automakers would have had to do this during a service and have been known to require hefty fees to update satellite navigation maps, something that is becoming standard to update for free remotely. Several vehicles now come with features that can be purchased or subscribed to at a later date.

With this transition to cars looking more like a mobile phone than a traditional car, major technology companies have taken an interest in the car market and, rather than supplying small components, are looking at providing the whole car.

Huawei was an early example of this approach and started selling its SERES SF5 in China in 2021. After many years of exhibiting automotive-related technology, Sony has entered a joint partnership with Honda to provide vehicles with production scheduled for 2026. Other examples that have announced projects include Xiaomi, Baidu (a joint venture with Geely), Foxconn, and others. Apple scaled back a fully autonomous car project, but rumours continue on an electric car project.

One of the key issues Tesla had initially was not with the core vehicle technology but the scaling up and quality control of manufacturing cars in large numbers, something that traditional automakers tend to do very well. This will be a big part of why these tech companies have often partnered with traditional automakers or other large manufacturers with experience. This sort of approach could see another key shift in how the automotive market is structured, with traditional OEMs manufacturing the vehicle and tech companies providing the software and integration. The benefit for the end user would be a well-built vehicle that integrates seamlessly with all of their other electronic devices.

Charging infrastructure

The global EV charging infrastructure market is growing steadily. According to IDTechEx, there were nearly 2.7 million public charging points worldwide in 2022. Nearly 960k chargers were installed globally just in that same year. IDTechEx estimates that 222 million chargers will be needed by 2034 to support the growing global EV fleet. IDTechEx also predicts that the cumulative global investment in global charging infrastructure will exceed US$123 billion by 2034 (hardware cost alone).

There is undoubtedly a huge push to build global public DC fast charging networks. China is leading the race with 1.797 million total public chargers deployed, taking ~70 per cent of the global market share. The US government is providing more than $5 billion in funding and incentives to build a coast-to-coast fast charging network under The National Electric Vehicle Infrastructure (NEVI) Formula Program. The Alternative Fuels Infrastructure Regulation (AFIR) in the EU is similarly driving the growth of public charger installations by mandating a station every 60km along highways. IDTechEx forecasts DC fast chargers to exhibit a higher growth rate in the coming decade, although AC chargers will dominate by unit volume in terms of deployment.

The Global EV charging network remains fragmented, with many chargepoint operators battling for market share across regions. Leading automakers recently adopted Tesla’s North American Charging Standard (NACS) charging connector for their US models. Tesla operates the largest global public DC charging network, and in North America NACS outnumbers CCS (combined charging standard) two to one, which explains the switch to Tesla’s standard. Furthermore, the network is more reliable and has 20-70 per cent lower deployment costs than their competitors due to in-house design and manufacturing of components. From a technical standpoint, Tesla’s connector is lightweight, supports both AC and DC through shared pins, and can support higher amperage due to immersion-cooled cables. IDTechEx’s outlook is that cars and EV supply equipment supporting CCS in the US will make up less than 50 per cent market share by the end of the decade, although it will remain the dominant standard across EU+UK regions.

Electric trucks

The electric truck market in Europe and the US is very much still in its infancy; data from the European Alternative Fuels Observatory (EAFO) suggests there were only 1,607 electric truck registrations in the EU27 countries in 2022, while estimates for the total number of electric medium and heavy-duty trucks on the road in the US is under 3,000 vehicles. However, all of the major OEMs have ongoing electric truck projects, and this work is intensifying, with all manufacturers recognising the transition to zero-emission powertrains has begun. In 2022 sales of electric heavy trucks in China reached an all-time high, totalling 25,072 units, an increase of 140 per cent on 2021.

Model availability has grown nearly 65 per cent from 2021 until the end of 2022 (from 182 models to 299). Globally, the most robust model-availability growth comes from heavy-duty truck (HDT) models, which reflect 95 per cent growth from 2021 to 2022 (57 models to 111 models) as the technology advances. Medium-duty truck (MDT) models grew 50 per cent year-on-year between 2021 and 2022. Zero-emission heavy-duty trucks have shown preliminary promise in urban freight and short hauling operations under 150 miles per day.