Mark Blinston, Commercial Director at BM Catalysts, maps the rising prices of precious metals and the subsequent effects on the production of catalytic converters.

2020 caused an enormous number of challenges for manufacturers of catalytic converters, with both rising raw material costs and COVID-19 putting pressure on the markets. As you might expect, 2021 will see more of the fallout from the pandemic and the ongoing price rises of precious metals – but also the start of a recovery.

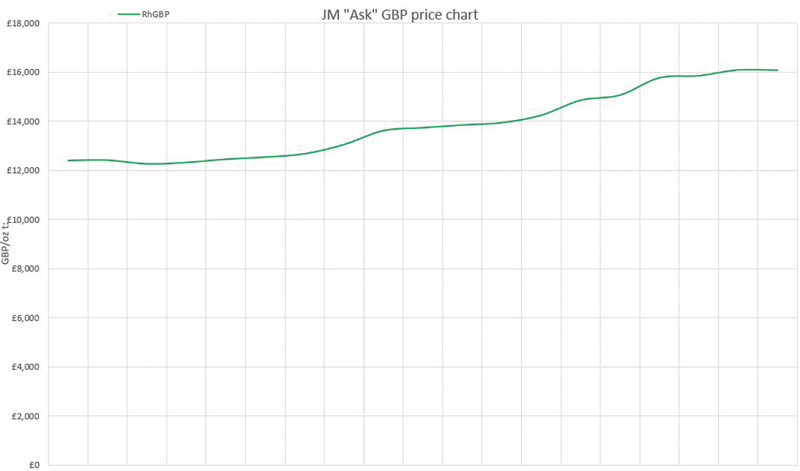

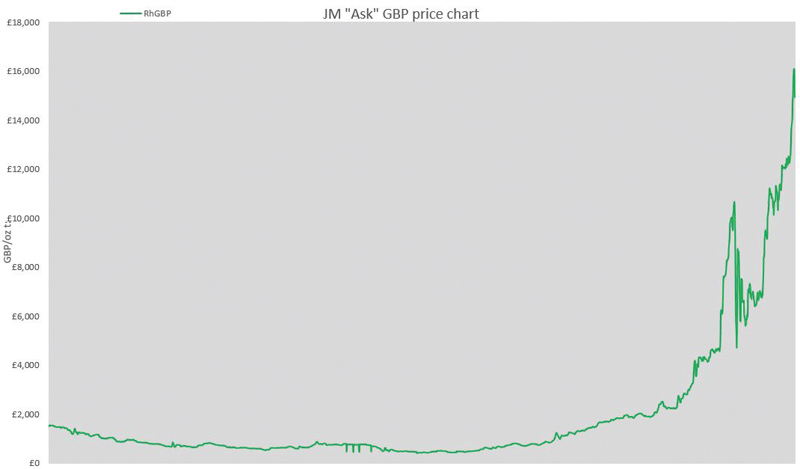

Over the past two years, precious metal prices have increased significantly. Rhodium for example, is one of the most expensive precious metals. It’s also one of the rarest elements on Earth and arguably one of the most volatile pricewise, having begun 2020 with a value of just over £4,000 per t oz before increasing a huge 157% over the following 12 months. It is now trading at well over £15,700 per t oz. At the time of writing, it remains volatile with sudden rises now common, and the price having increased by 30% since mid-December alone (Fig 1).

Rhodium currently trades at around nine times the price of gold (at time of writing). Palladium meanwhile has experienced a less spectacular rise, although has still seen a 20% increase.

Why is it so pricey?

There are many factors influencing this sharp rise in precious metal prices, in particular rhodium, which has left the price of gold in its wake. The global drive to improve air quality, particularly in areas like China and Europe, has seen demand surge for rhodium and palladium. Furthermore, the trend of moving from diesel to petrol puts additional pressures on rhodium which is not used in diesel applications.

Another reason its price is sky-high is the tightness of supply. More than four out of every five ounces of rhodium are mined in South Africa, extracted in minuscule quantities alongside more abundant metals such as platinum, palladium and gold. Despite South Africa’s COVID-19 alert level, some production activity has increased, but existing barriers have also prevented them from restarting all activity. With deficits in supply, some experts are predicting rhodium price rises until 2024. In 2008, rhodium touched £5,560 per t oz as the global financial crisis hit, which then saw the metal price crash by 90% just weeks later (Fig 2).

This was an artificially high price and is unlike the price rises we see in the market today.

The current price of rhodium has never been seen before and with that brings the risk it could crash again like in 2008. With so much uncertainty over the future of the price of this rare metal, 2021 is likely to be another volatile year with either regular price increases or a sudden drop, as seen between 2017 and 2020 in Fig 3.

Although the automotive sector is the primary consumer of platinum group metals (PGMs), demand also comes from buyers such as jewellery makers and commodity investors.

An increased cost of the PGMs used in the making of catalytic converters has to be reflected in their sale price – it’s unavoidable. The price of the PGMs used can be up to 90% of the overall cost of producing a catalytic converter, underlining the fact that the price of parts is dictated almost entirely by the market performance of these metals.

In anticipation, BM Catalysts has moved to a shorter-term purchasing strategy to ensure it remains competitive if the metal prices drop significantly.

Catalytic convertor theft

London Police are reporting a 50% increase in the theft of catalytic converters compared to the same time last year as PGM values continue to soar.

Motor insurer, Admiral, says it received 400 claims in one month alone in 2020 for damage caused to vehicles from the theft of catalytic converters. It also says that thieves are focusing on hybrid cars as the catalytic converters found on these vehicles contain a higher concentration of precious metals and are generally less corroded. Thieves are also becoming more and more brazen, pulling up in broad daylight to commit the theft and being able to steal converters in as little as 60 seconds.