Do you ever feel like your business is managing you, rather than the other way around? When you’re running a busy garage, it can be easy to lose sight of what the ultimate objective is: making a profit. Luckily, Andy Savva, AKA The Garage Inspector, has launched a series of Business Training Days, tailored specifically to running a garage business. PMM headed to Crawley to attend one of the sessions and see what it’s all about.

Andy Savva is a familiar face in the trade. He’s written articles for PMM, he’s given presentations at trade shows and training events up and down the country and is a member of innumerable aftermarket bodies and committees. It’s hard to argue that Andy doesn’t know what he’s talking about – he’s owned and managed garages since 1994 and has redefined what it means to be ‘successful’ as a garage owner in the UK.

Having eventually sold his final business – Brunswick Garage, seen by many as the new benchmark in the trade – Andy recently re-branded as The Garage Inspector, with the aim of sharing his knowledge and passion for the industry with garage owners.

The Business Training Days cover Marketing Essentials, Financial Understanding for the Garage Business, and Customer Excellence. Each course lasts a full day, with lunch and refreshments provided. 2018’s destinations spanned from Crawley to Glasgow, with sessions also taking place in Northampton and Exeter, and next year’s calendar boasts venues covering the full length and breadth of the country.

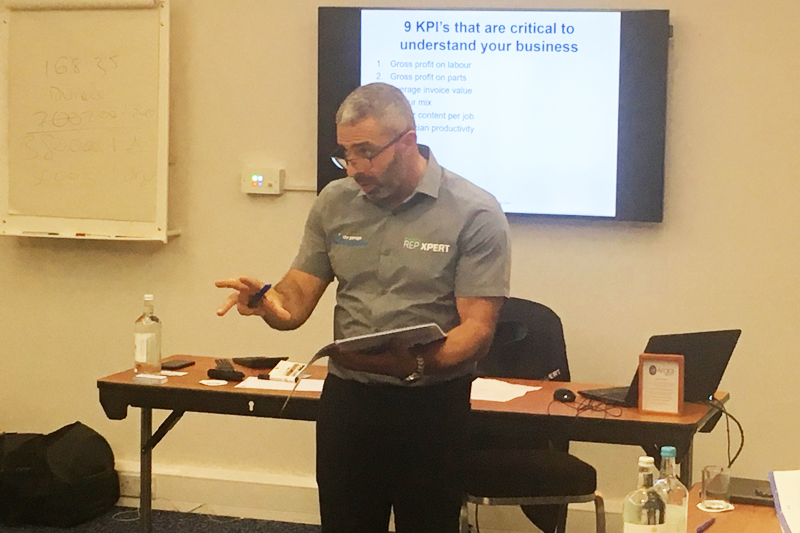

PMM attended the Financial Understanding session in Crawley in October 2018, along with a selection of garage proprietors, operations managers, company secretaries and technicians – all with the common purpose of learning how to manage their garage’s finances more effectively.

As with all of Andy’s training sessions, the training was delivered in an engaging and professional manner, but with a personal touch. The content of the course is informed by Andy’s own experience of running garages, along with knowledge that he’s picked up from his university studies and other industry roles. Each module features a detailed workbook that contains all of the course content. The workbooks were used for reference and practice exercises throughout the day, and the content is expertly presented in a way that makes it easy to grasp.

The objectives of the Financial Understanding session were five-fold:

1.) To explain your impact on organisational finances and interpret key facts

2.) To understand financial terms and confidently discuss issues that affect company finance

3.) To interpret the three key financial statements – Profit & Loss, Balance Sheets and Cash Flow Statements

4.) To understand KPIs – what they are and how they can be used to help performance

5.) To understand why the correct labour rate is critical to a garage

After a brief introduction from Andy, the course got into full flow, with delegates encouraged to voice their opinions and ask questions at regular intervals. This was one of the most inspiring aspects of the course – like-minded people sharing their views and ideas with each other and offering each other advice. So, not only did attendees learn from the Inspector himself, but they compared notes with other garage owners as well.

Here’s what some of the delegates had to say about their experience.

Tina Drayson, Operations Manager, CCM

“After spending two days with Andy earlier in the year for a garage inspection at our two depots, and hoping to gain some insight and understanding of how we could manage and measure our business in a more effective way, we decided to attend Andy’s course ‘Financial Understanding for the Garage Business’.

“We were not disappointed. Andy’s knowledge of the industry is phenomenal. We touched on the importance of cash flow, profit and loss and balance sheets, followed by an endless list of KPIs and how we can measure them – and more importantly, what they tell us. With a few simple calculations that can be applied to historical data, you have gained a wealth of knowledge about your business, and about your team, even the basics of how much an hour it costs just to open your doors. From this, you can really begin to understand your business and how you can grow in the right direction.

“Andy’s passion comes out in his teaching skills. He is very engaging, authentic and professional, and takes his time to ensure each and every delegate understands. We had a workbook to follow, which allowed us to try some sample data which really got everyone thinking. I am sure that each and every person who has ever attended one of these sessions has been motivated to go back to the drawing board and try these calculations themselves. Why? Because they work. Andy has demonstrated this by his own success in the industry.”

Darren Cotton, AVC UK

“Andy Savva’s feedback on social media and closed forums within the industry caught my attention. I realised that as an independent workshop owner I have not seen anything like this available to my independent network. I attended two courses: Customer Excellence and Financial Understanding, and I found both very interesting and have taken so much from them and have been inspired from what I have learnt.

“Andy is a very confident speaker. He’s inspiring, energetic and passionate about the industry. I would advise any garage owner to attend these courses. It doesn’t matter how big or small your business is, you will gain so much from it.”

Elisa-Jane Bramall, Scantec Automotive

“If you work in the automotive repair industry, whether it’s a general garage, an MOT test centre, a bodyshop or diagnostics specialist (like me) you will certainly benefit from attending one of The Garage Inspector’s courses.

“The course content was robust and well structured, clear and simple to understand, with a complete workbook to take away for review. In short, it was excellent value for money.

“By attending this course you will walk away with a better understanding of how your work, time and efficiency impacts on the business and how you can make changes to improve this – which is what we all ultimately want, right?

“Understanding the general finances of your business is one thing. You may think you have a grasp on your accounts and where your business is going, but let me tell you – there is so much more to learn, even if you are responsible for the day-to-day accounts. I thought I understood our business accounts, but now I have developed several ways of assessing our figures to truly appreciate where we are, where we want to be and, more importantly, how we will get there.

“As I run our accounts on a daily basis, I consistently monitor our sales, expenses and objectives. One of the most difficult things to plan for is our training budget – which is the most important area for investment in the business we run. I thought I knew the figures off the top of my head – but I was wrong. One of the first questions Andy asked was: “How much does it cost to do business per day? Per hour?” I could take a good guess, but I didn’t know the true figure. This was only the start!

“You could look at your books and make plans to increase your profits by perhaps increasing your labour rate or cutting costs.

But there are so many other ways to achieve this without changing the figures. Having said that, you may come away from this course with a better understanding of your worth, as well as the realisation that you aren’t charging enough and that you must assess your current labour rate.

“With Andy’s wealth of knowledge, experience and the methods he has developed, you can look at data you have collected over time and apply some basic calculations to truly understand what makes money and what loses money – a lot of which you wouldn’t know otherwise. More importantly, you can assess these numbers and identify how you can take more control of the outcome in the future – just by understanding how you can measure yourself and your team.

“I have come away with a refresher on accounting terms and cash flow. I have the tools to understand and appreciate what we need to do to ensure we are as productive and efficient as is reasonably possible. I now plan our financial objectives using accurate data in a ‘worst case scenario’ and feel confident about our future investments and plans, which ultimately allows us to accurately budget for our training activities.”

2019 DATES ANNOUNCED!

21st February – Nottingham 28th February – Dublin

4th March – Cardiff

26th March – Preston

3rd April – Shrewsbury 9th April – Oxford

11th April – Norwich 14th May – York

21st May – Newcastle