Do you know your margin from your mark-up? In this month’s article, Andy Savva tells you why you should.

Andy Savva is a former multiple independent garage owner who boasts over 30 years’ experience in the automotive repair sector. In every issue of PMM he’ll be sharing his advice with workshop owners who want to improve their business’ bottom line, but simply don’t know how to go about it.

In all the years I have been writing articles and presenting at automotive events, an issue that constantly crops up is the lack of understanding of margin and mark- up. The two are often used interchangeably, when in fact they could not be more different.

I have to be honest here and disclose this was also the most difficult concept for me to master. I believe margin and mark-up are a problem for most of us because they are both related to the same thing, which is the difference between the selling price of an item and its cost. The issue is in the way we deal with this difference.

The simple definition of margin is: The difference between the cost and the selling price of an item. Mark-up, however, is different. It can be defined as: An amount added to cost in calculating a selling price.

Now, this is very important to understand. If you were to calculate 50% margin of profit and a 50% mark-up for the same item, they would not equate to the same amount. The confusion occurs because the only known amount you generally have with regard to pricing is the cost of the item, be it parts or labour cost. The correct selling price is unknown until calculated. So, just to reinforce the point: margin of profit is always calculated as a % of the selling price, whilst mark-up is applied as a % of an item’s cost.

Margin

As a garage owner, I decided that I needed to aim for an overall gross profit margin of 50% on parts that we purchased. To achieve this, I learnt that I had to divide the cost of parts by 0.5. For example, if a part cost £112.75, dividing it by 0.5 gave me the selling price of £225.50, thus maintaining the 50% margin, or £112.75. If you divide the purchase cost (£112.75) by the selling price (£225.50) it gives you 50% margin.

However, what sometimes used to happen was a recommended retail price of a part fell below our target gross profit of 50%. For example, if the cost of a part was £75.12 and the retail £98.45, by subtracting the cost from the retail, we are left with £23.33. If we then divide £23.33 by the recommended retail price (£98.45) this gives us a gross profit margin of only 23%. This is not unusual and it’s for each individual garage owner to decide minimum and maximum margins of parts purchases.

As a guide, at most of my garage business we had always set a minimum of 35% and maximum of 60% margin on parts purchases in order to achieve our overall aim of 50% margin. We set individual parameters on our garage management system for specific product groups like brakes, steering, suspension, and service items in order to ensure consistent pricing and, more importantly, to maintain our desired margins.

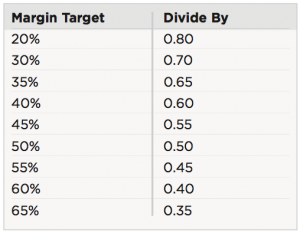

Below is a margin calculator to help you – using the cost of the part as the starting point.

Mark-up

Mark-up is expressed as a percentage of the cost of a part. So, if a wheel bearing cost £80.00 and you wanted to achieve a 50% mark-up, you would apply 50% of the part to the overall cost. For example, £80.00 x 50% gives £40. Add that to the original cost of £80 and this gives you £120, which represents 50% mark-up.

Now using what we already know, we can now work out the margin as follows:

£40 (50% mark-up) divided by total selling price £120.00 results in 33% margin.

Using these parameters in my garage businesses gave me a better chance of maintaining a consistent profit margin on all parts, and the same method was used to calculate margin on labour. For instance, on labour we wanted to achieve a margin of between 75% and 85% so our cost of labour was £20 divided by 0.25, which gave us £80 per hour when we started back in 2011. When I sold my business 18 months ago, our labour rate had risen to £90 per hour.