AutoMate’s Harrison Boudakin reports on the state of the automotive market as we near the close of 2018, and discusses what’s on the horizon for the industry going forward into 2019 and beyond.

In the automotive history books, 2018 will go down as yet another significant footstep on the industry’s long stagger towards a post-combustion, autonomous, connected future. Thanks to a swirling combination of political, legislative and consumer factors, this year was generally not a comfortable one for the automotive establishment, with almost every legacy brand being buffeted by the challenge of interpreting the future based on the present market – a costly process requiring careful hedging against unsteady treads, and heavy investment in uncertain technologies.

Like any business, the auto-sector largely detests instability. Rather than craving the disruptive, in truth, most automakers subscribe to Karl Popper’s theory of piecemeal engineering, the practice of small measures. Turn a screw here, open a valve there, but whatever you do, make sure not to rush the change.

Increasingly, though, it became clear through 2018 that certain forces were no longer willing to tolerate this lingering status quo. In Europe at least – still the beating heart of global automotive thinking – the major flashpoint was emissions legislation. The hangover from Volkswagen’s Dieselgate rolled on, with legislators across the EU sanctioning an increasingly-heavy arsenal of policies designed to fillet the once-thriving diesel market in the UK and in Europe.

It clearly had an effect – over the first half of 2018, sales of new diesel cars in the UK fell by over 30%, and the trend lines show similarly sharp declines will continue through to 2019 and beyond, while sales of petrol models rise to fill the gap (for the time being). Continental Europe recorded similar average dips for compression-ignition vehicles, on the back of a legislative and rhetorical roasting, which has very prominently put diesel on trial for rising noxious emissions levels in major cities across the EU.

Put simply, this means that at the end of 2018, the calculus is now very different for automakers compared to the same time three or four years ago. Electrification is now on their agendas in a big way, with legislators having set a benchmark of 15% of all sales to be either electric or plug-in hybrid by 2025, rising to 30% by 2030. These proposals will allegedly bring about a reduction in average fleet emissions by 30% from 2021 – but the climb to reach the benchmark will be steep and expensive for automakers.

Not only is the technology outside their traditional ‘centres’ of engineering gravity and influence, there is also the simple fact that right now the market uptake of electrically-chargeable vehicles is low, and this is not due to a lack of availability or choice. Rather, affordability, market conservatism and the overarching issue of practicality (tied into the question of charging infrastructure) are the predominant anchors for semi- and full-EV take-up. Demand for these vehicles did increase during 2018, with 20-25% gains in UK sales volume across the first half of the year, and similar figures expected going forward. Given that they still represent only about one in 20 registrations, though, there’s a long way to go before electrically-charged cars are standard household fare.

Even so, at the top end of the market, 2018 was noticeable for the efforts taken by legacy manufacturers to boost the image of EVs in the imagination of the buying public. Indeed, if one car stood out this year, it would have to be Jaguar’s I-Pace SUV, the fully-electric British crossover, which beat its German rivals to market by a handsome margin, and looked really quite good doing it too. As a frontiersman for British automotive ingenuity in a time of uncertainty, this car was a powerful symbol. Mercedes’ EQ C SUV and Audi’s e-Tron quattro will follow shortly, along with Porsche’s Taycan, proving that at the pointy end of the market, automakers are ready to build up some real EV credibility.

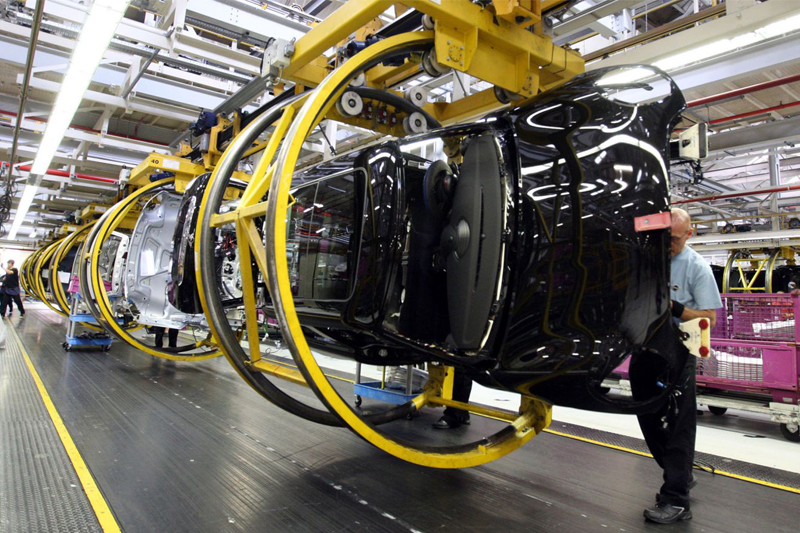

Speaking of uncertainty, we would be remiss not to take stock of where the auto- industry sits in terms of the Brexit discussions. For all the conjecture and debate about Brexit itself, there is a remarkably clear consensus in the auto-industry on Brexit. All they want is certainty: certainty about the nature of the trading relationship with the EU, certainty about how significantly their delicately- engineered just-in-time parts supply chain will be disrupted come March 2019. As negotiations over the UK’s Brexit deal have been clouded in recent months, the auto-sector has become increasingly vocal about its concerns, to the point where some big players have foreshadowed plant closures in the event that a deal is delayed, or none is reached at all.

And the uncertainty is already provoking a sizeable downturn in investment, with the SMMT reporting that investment in new models, automotive equipment and facilities halved this year compared with 2017. It is worth noting, however, that while the British car industry is vulnerable to certain Brexit outcomes, the dependence of the European auto-sector on sales and parts supply from Britain is also significant. In other words, in the instance of the auto-sector, the Brexit knife can – and probably will – cut both ways.

In its totality, then, the story of 2018 represents one of challenge and change for an automotive industry weathering a storm of uncertainty. In all likelihood, this is likely to intensify as we move forward into 2019 – so the real question is who will emerge weakened by events and trends that now seem unavoidable, and who will thrive from the new market opportunities created as the status quo continues to shift? Only time will tell.