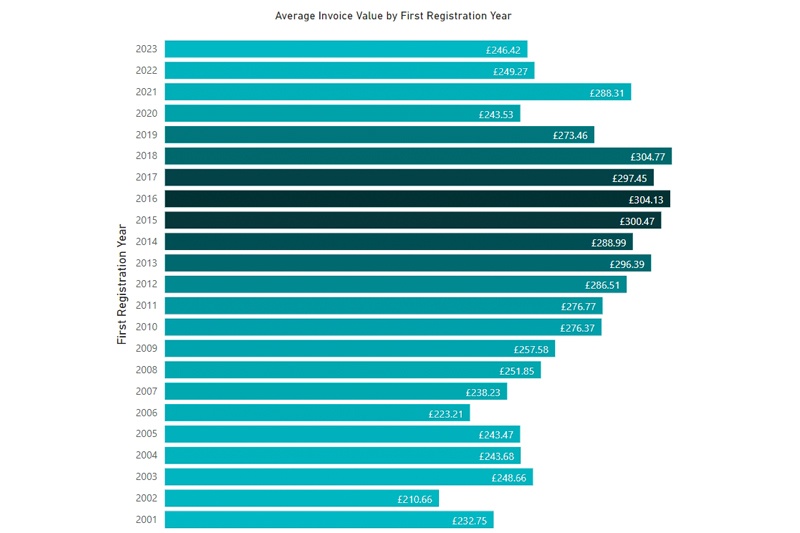

Community-driven garage management system Garage Hive has enhanced data website Garage Industry Trends. Trends 2.0, released at The Blend last October, now adds revenue analysis by car age and fuel type.

Since launching a year ago, the Trends data collection platform – which is a free research resource to access – has seen 140 garages opting in to share anonymised data, with over 4,000 unique visitors to the site. Garage Industry Trends uses two core categories of data. First, there’s aggregated data from opted-in independent garage customers of Garage Hive. Four key averages are tracked, namely invoice value, labour rate, future bookings, and net promoter score (NPS).

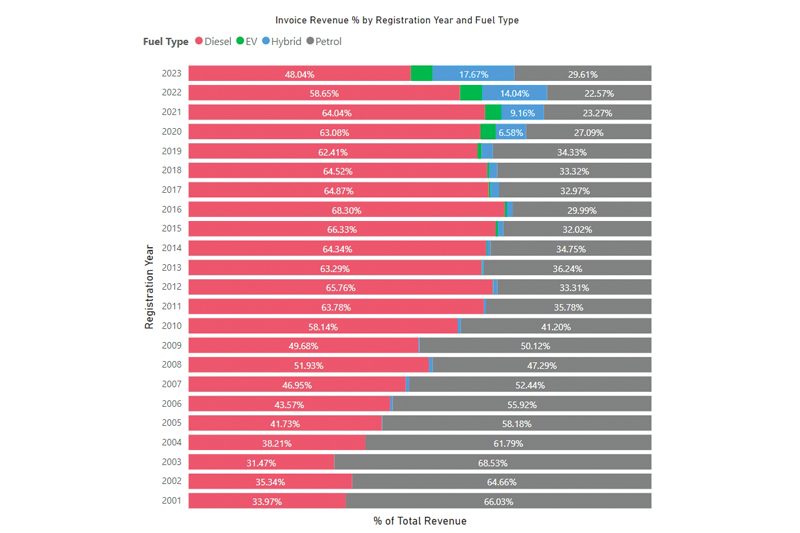

Trends 2.0 develops this further by giving more detailed breakdowns of garage revenue. The purpose of Trends remains to promote understanding and discussion to support data-driven insights into the opportunities and challenges ahead. It clearly reveals the source of today’s revenue for garages stands in sharp contrast to the future composition of the UK vehicle parc.

“Revenue by fuel type gives a factual current picture of the challenges independent garages face as the UK vehicle parc transitions to EV,” said Alex Lindley, Director of Garage Hive. “Our community are amongst the most forward-thinking independent garages, yet during 2023 nearly 98 per cent of their revenue came from ICE vehicles, with nearly two thirds from diesel engines.”

The second category of information ‘MOT Data Trends’ analyses is 250 million lines of government MOT data. This has been enhanced with not only a more comprehensive suite of reports but also updated with the complete 2022 dataset for UK MOT tests completed.

“Trends has already helped on the government’s 4-2-2 MOT consultation, offering clear evidence why reduced MOT test frequency would be detrimental for UK road safety,” said Alex.

‘MOT Data Trends’ reveals EVs are much more likely to fail MOTs for tyre wear than combustion engine vehicles. Besides the extensive standard reports, there’s capability to dive deeper into the data using Microsoft Power BI reporting tools.

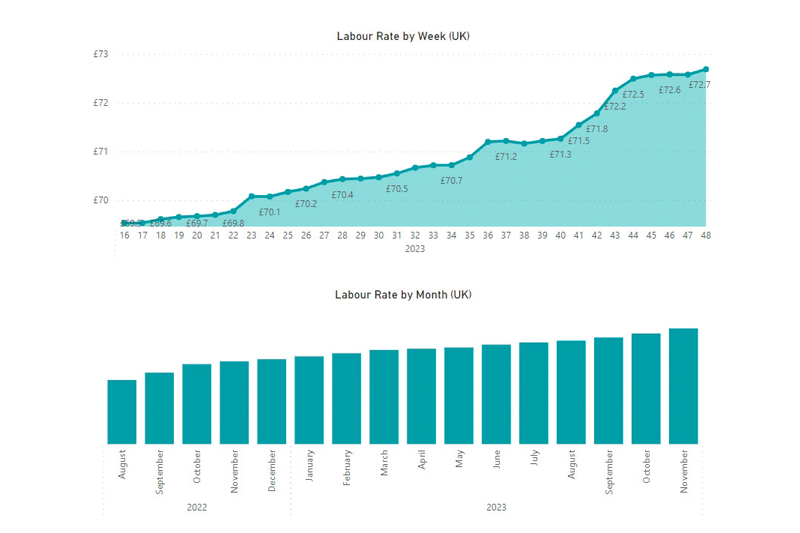

Having been running for just over 12 months, changes over time now make interesting reading too. Future demand fluctuations are greater throughout the year than used to be the case, a legacy of the continued impact of the 2020 Covid MOT extension. Meanwhile, average labour rate has risen by over 10 per cent throughout 2023 to £72.50, reflecting cost rises and wider inflationary pressures within the UK economy.